Read what we read

On this page you find the posts from us, our senior advisors and our managers as well as the latest news and research from the organizations that we follow. Add your email address below if you wish to receive updates from us in your inbox.

Five charts on the global energy transition, Ember, August 2025

Driven by plummeting costs, modular design, and rapid deployment, solar power is becoming the backbone of the new global energy system. In each of the last three years, solar energy has been the largest source of new electricity globally. No other electricity source has scaled this quickly.

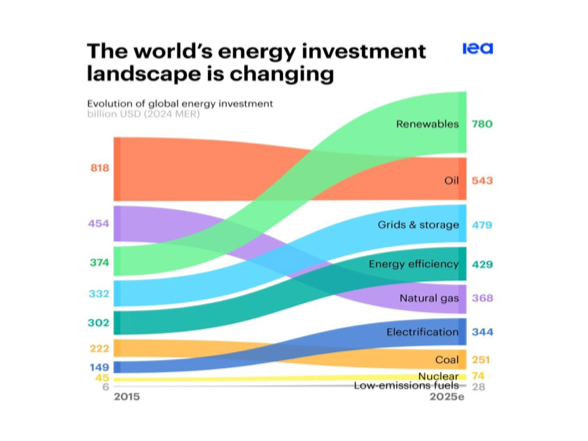

World Energy Investment 2025, IEA June 2025

Investment trends are being shaped by the rapid rise in electricity demand for industry, data centres, and artificial intelligence (AI). Investments in renewables, grids, storage, nuclear, low-emission fuels, efficiency, and electrification are expected to be twice as much as the investments in oil, natural gas, and coal in 2025.

The importance of Climate Tech for European resilience, White Paper, February 2025

For too long, Europe has depended on China for trade, Russia for energy, and the US for security. As the global geopolitical landscape undergoes profound shifts, Europe must reassert itself. This White Paper, co-authored by World Fund, Kaya Partners, and Worthwhile Capital Partners, outlines key recommendations for resilience.

The 2024 Annual Climate Summary, Copernicus Climate Change Service, January 2025

2024 saw unprecedented global temperatures, following on from the remarkable warmth of 2023. Multiple records were broken, for greenhouse gas levels, and for both air temperature and sea surface temperature, contributing to extreme events, including floods, heatwaves and wildfires.

World Energy Outlook 2024, IEA, October 2024

Regional conflicts and geopolitical strains highlight significant fragility in today’s global energy system, according to the IEA. This clarifies the need for stronger policies and greater investments to accelerate and expand the transition to cleaner, more efficient and more secure technologies.

Upwind Moisture Supply Increases Risk to Water Security, Nature Water, September 2024

A new study shows how the assessment of the stability of the global water supply is dependent on factors much earlier in the system. This means global risk to the water supply changes if you also consider the source of the rain. According to the study, upwind moisture is commonly overlooked when assessing water availability.

The Hard Stuff; Navigating the Physical Realities of the Energy Transition, McKinsey Global Institute, August 2024

The report highlights seven interlinked areas of the energy system that need transformation, a process still in its early stages. Addressing twenty-five key physical challenges in these areas is crucial for progress, and understanding these will help CEOs and policymakers steer a successful transition.

World Energy Investment Report 2024, IEA, June 2024

Spending on clean energy, such as renewable power, grids, and storage, is now higher than total spending on oil, gas, and coal. Yet more needs to be done. In most cases, this growth comes from a very low base, and many of the least-developed economies are left behind.

European State of the Climate 2023, Copernicus, April 2024

Since the 1980s, Europe has been warming twice as fast as the global average, becoming the fastest-warming continent on Earth. The frequency and severity of extreme events are increasing, with widespread flooding in northern Europe and widespread droughts in southern Europe.

The European Electricity Review, February 2024

We really like Ember, and they provide data for free. Their latest European Electricity Review illustrates that the energy transition is moving forward. A record fossil fuel collapse shows the shift to clean power in action.

The Global Risks Report 2024, World Economic Forum, January 2024

While climate-related risks remain the dominant theme long term, the threat from disinformation and misinformation in large part driven by AI, are identified as the most severe short term threat in the 2024 report from World Economic Forum.

Renewables Report 2023, International Energy Agency, January 2024

In the next five year period we will see a yet further incredible growth in renewables deployment. The world is on course to add more renewable capacity in the next five years that has been installed since the first commercial renewable energy power plant was built more than 100 years ago.

Carbon Brief Clear on Climate, November 2023

Global carbon dioxid (CO2) emissions from energy use and and industry could peak as soon as this year, according to Carbon Brief analysis of figures from the International Energy Agency (IEA). Other highlights from the report includes fossil fuel peaks are being driven by the “unstoppable” growth of low carbon technologies.

Siddarth Shrikanth, 2023

One of the most recent additions to our library is the outstanding book by Siddarth Shrikanth on biodiversity and natural capital solutions. Shrikanth argues that cutting emissions will not to be enough to achieve net-zero goals. We also need to invest in protecting our natural assets and building a closer relationship with the planet.

International Energy Agency, October 2023

The IEA has released its first ever, country-by-country, report on grids and what will be needed to speed things up with grid investments and build-out. As the report argues, we need to build or replace 80 million km of power lines by 2040, equivalent to the size of the entire global grid set up over last century.

Stockholm Resilience Centre, September 2023

Scientists have detailed an outline of planetary resilience by mapping out all nine boundary processes that define a safe operating space for humanity. Unsurprisingly, we have already crossed six of these. We don’t know for how long we can keep transgressing these boundaries before combined pressures lead to irreversible change and harm.

Nature Communications, July 2023

The Atlantic meridional overturning circulation (AMOC) is a major tipping element in the climate system and a future collapse would have severe impacts on the climate in the North Atlantic region. It would increase storms and drop temperatures in Europe, and lead to a rising sea level on the eastern coast of North America.

International Panel on Climate Change, March 2023

Scientists have delivered a 'final warning' on the climate crisis, as rising greenhouse gas emissions push the world to the brink of irrevocable damage that only swift and drastic action can avert. The comprehensive review of human knowledge of the climate crisis can be boiled down to one message: act now, or it will be too late.

NASA, March 2023

Scientists have predicted that droughts and floods will become more frequent and severe as our planet warms and climate changes, but detecting this on regional and continental scales has proven difficult. Now a new NASA-led study confirms that major droughts and pluvials have indeed been occurring more often.

World Economic Forum, January 2023

Al Gore lashes out at decision makers at 2023’s World Economic Forum in Davos by telling it as it is; “The crisis is still getting worse, faster than we are deploying the solutions – and we need to make changes, quickly. Emissions are still going up… We have to have a sense of urgency much greater than we have yet had”.

International Energy Agency, October 2022

With the world in the midst of the first global energy crisis – triggered by Russia's invasion of Ukraine – this report provides indispensable analysis and insights on the implications of this profound and ongoing shock to energy systems across the globe.

WMO, UNEP, GCP, UK Met Office, IPCC & UNDRR, September 2022

At a time when urgent action to address climate change is needed, this report provides unified scientific information to inform decision-makers and highlights some of the physical and socioeconomic impacts of the current and projected climate.

World Economic Forum, July 2022

The framework assesses sectoral readiness for net zero by evaluating key enablers such as the readiness of technology, access to the enabling infrastructure, the robustness of supporting policy frameworks, the strength of demand signals for low-emission products and the availability of capital for investments in low-emission assets.

Worthwhile Capital Partners, June 2022

We are super grateful for the trust that investors and fund managers have put in us since we created our fundraising team. In our first few years in business we have raised our first billion dollars to sustainable investments, avoiding more than 49m tonnes of CO2-emissions!

International Energy Agency, June 2022

This report concludes that despite an increase in the growth of investment, today’s levels of capital spending are still far from sufficient to tackle the energy and climate crises. As new trends within this space are emerging, the IEA has included a detailed review of investment trends for critical minerals needed for clean energy technologies.

World Economic Forum, May 2022

This special edition report on global energy transition builds on the trends from the Energy Transition Index to provide perspectives on the current challenges and recommendations on how to navigate the transition through a turbulent macroeconomic and geopolitical environment.

World Meteorological Organisation, May 2022

The WMO State of the Global Climate in 2021 report confirmed that the past seven years have been the warmest seven years on record. Moreover, four key climate change indicators: greenhouse gas concentrations, sea level rise, ocean heat and ocean acidification, all set new records in 2021.

Intergovernmental Panel on Climate Change, April 2022

The Working Group III report provides an updated global assessment of climate change mitigation progress and pledges, and examines the sources of global emissions. It explains developments in emission reduction and mitigation efforts, assessing the impact of national climate pledges in relation to long-term emissions goals

Worthwhile Capital Partners, March 2022

Mrs Bulhakova joins directly from the Kharkiv National University of Civil Engineering and Architecture in Ukraine. She takes a great interest in all environmental issues and will support the firm in creating marketing material and presentations, as well as in developing its marketing strategy

Intergovernmental Panel on Climate Change, February 2022

“Today’s IPCC report is an atlas of human suffering and a damning indictment of failed climate leadership,” said UN Secretary-General Antonio Guterres. The temperatures are already getting too hot, disasters are becoming too severe, and the costs of staying put are becoming unbearable for millions of people.

Worthwhile Capital Partners, January 2022

Mr Hellström will support WCP in Manager Selection, Fund Due Diligence and Long-Term Strategy Formation. He has a long and distinguished career in alternative investing, most recently at AP3, Third Swedish National Pension Fund, where he was Head of Alternative Investments for twenty years. Prior, he was at EQT Partners and at Investor.

World Economic Forum, January 2022

Although the biggest changes in the survey are found in Social Cohesion Erosion and Livelihood Crisis, Climate Action Failure and Extreme Weather still dominate long-term risk perception. Sustainable investing is critical to mitigate these risks and to alleviate concerns

Journal of Impact and ESG Investing, December 2021

There is an urgent need to decarbonise our economies, and the market for renewable energy is growing at scale. Renewables investing is an opportunity for investors requiring sustainable impact while enhancing risk-adjusted returns. But investors also need to be mindful of the risks. This article outlines the key considerations

International Energy Agency, October 2021

Published since 1977, this is the most reviewed energy report in the world. Released just ahead of COP26, the 2021 report provides an indispensable guide to the opportunities, benefits and risks ahead at this vital moment for clean energy transitions.

UN-convened Net Zero Asset Owner Alliance, October 2021

While the IPCC report confirmed the negative human impact on climate, the IEA World Energy Outlook report illustrated what can be done about it, this UN Net-Zero Asset Owner Report explains the progress by investors so far.

US Department of Energy, September 2021

This study finds that with aggressive cost reductions, supportive policies, and large-scale electrification, solar could account for as much as 40% of US electricity supply by 2035 and 45% by 2050. To reach these levels, solar deployment will need to grow by four times its current deployment rate.

Intergovernmental Panel on Climate Change, August 2021

This study evidences the cause of global warming and warns of increasingly extreme heatwaves, droughts and flooding. Under all the emissions scenarios considered by the scientists, the 2 °C target will be broken this century unless huge cuts in carbon take place.

International Monetary Fund, December 2020

This paper demonstrates how climate change alters sovereign credit ratings by providing valuable guidance on the future impact of climate change-related risks on how much governments and firms can safely borrow and how much it will cost them. Unfortunately, the least resilient developing economies will suffer most from these changes.

The World Scientists’ Warning of a Climate Emergency, BioScience, July 2021

Planetary vital signs are indicating troubling trends, along with little progress by humanity to address climate change. There is mounting evidence that we are near or have already crossed tipping points associated with critical parts of the Earth system, including West Arctic and Greenland ice sheets and the Amazon rainforest.

Transition Pathway Initiative, April 2021

TPI reviews the progress made by the world’s highest-emitting public companies on the transition to a low-carbon economy. The main findings show that most companies’ emissions targets are not ambitious enough. However, there is now encouraging momentum behind genuine net zero targets becoming increasingly more long-term.

Vivid Economics, February 2021

Out of the total US$14.9 trillion stimulus announced to date only US$1.8 trillion has been green. However, Biden’s US$1.7 trillion Climate Plan would nearly double that whilst propelling the US as a model for how investment-driven growth and regulatory change can create jobs, improve productivity, reduce emissions and protect nature.

NextEnergy Capital, January 2021

As investor demand increases for solar PV investments, NextEnergy Capital announces further acquisitions for a total portfolio of 430MWp for their fund NPIII, and an additional and exclusive pipeline of 500MWp. The fund remains open for investor commitments until the middle of this year.

World Economic Forum, January 2021

Despite the pandemic and geopolitical turbulence, climate risks still populate four of the top five risks identified by the WEF. As the authors correctly point out, if environmental considerations are not confronted in the short term, environmental degradation will intersect with societal fragmentation to bring about dramatic consequences.

Foresight Group, January 2021

Foresight Group conducts third close for Foresight Energy Infrastructure Partners (FEIP) with total Fund commitments of €430 million, and total capital pool of over €600 million. The fund is now 86% committed and final close is planned for July 2021.

Capital Finance International, November 2020

“Worthwhile Capital Partners is quite unapologetic about its philosophy and mission. The CFI.co judging panel applauds Worthwhile Capital Partners for not just taking the road less travelled, but for blazing a trail with its carefully crafted approach to impact investing.”

Worthwhile Capital Partners, October 2020

The expansion follows the strong demand for the Firm’s fundraising services in 2020-21. Martin Sonesson joins Worthwhile Capital Partners from UBS in Luxembourg in December 2020. The firm is also appoints Sony Kapoor and Niclas Sundstrom as senior advisers on finance, sustainability, politics and geopolitics.

International Energy Agency, October 2020

Renewables grow rapidly in all our scenarios, with solar at the centre of this new constellation of electricity generation technologies. Electricity grids could prove to be the weak link in the transformation of the power sector, with implications for the reliability and security of electricity supply.

Worthwhile Capital Partners, October 2020

In this inaugural letter to investors, we reflect on the accelerating impact of climate change, the state of financial markets and how growing investments related to the decarbonisation of energy systems can offer attractive risk-return for long-term investors.

Foresight Group, September 2020

This is a great 23-page research publication by Foresight Group assess how resilient different infrastructure sub-sectors are to global pandemics, with significant emphasis placed upon the impacts of Covid-19 to date.

IRENA, June 2020

Newly installed renewable power capacity increasingly costs less than the cheapest power generation options based on fossil fuels. The cost data presented in this comprehensive study from the International Renewable Energy Agency (IRENA) confirms how decisively the tables have turned.

NextEnergy Capital, June 2020

NextEnergy Capital is delighted to announce that NextPower III has won the prestigious international award of “Renewables Fund of the Year” in Environmental Finance’s Sustainable Investment Awards 2020. The Award demonstrates NextPower III’s rigorous implementation of the ESG principles which helps to maximise the funds’ performance.

Frankfurt School & BloombergNEF, June 2020

This report shows that renewable energy capacity, excluding large hydro, grew by a record 184 gigawatts (GW) in 2019. This was 20GW, or 12%, more than new capacity added in 2018. Yet the 2019 dollar investment was only 1% higher, at $282.2 billion.

Global Infrastructure Hub, June 2020

This report illustrates the trends that are disrupting infrastructure investing, including the rapid evolution of technology, increasing urbanisation, climate change, compression in expected financial returns in a low rate world, and changing consumer preferences.

Yale Program on Climate Change Communication, April 2020

New poll finds a majority of American voters support financial relief for hospitals, small businesses, and renewable energy companies, while fewer than half support bailouts for oil and gas companies, cruise lines, and casinos. In a country historically based on domestic fossil fuel energy generation, this is interesting.

IEA, April 2020

In an extended Global Energy Review, IEA presents the impacts of the Covid-19 crisis on global energy demand and CO2 emissions. It has tracked energy use by country and fuel over the past three months and in some cases in real time and draw key lessons on how to navigate this once-in-a-century crisis. Good read.

SolarPower Europe and LUT University, April 2020

In March 2020, the European Commission made a fundamental move by submitting a proposal for the “Climate Law”, pledging to become the first climate-neutral continent. Any kind of stimulus package offers the possibility of accelerating the energy transition and make Europe the first climate neutral continent by 100% renewables.

NordSIP, April 2020

The Foresight Group has announced it closed a syndicated co-investment deal for the greenfield 231MW Skaftåsen onshore wind project in Sweden, through its Foresight Energy Infrastructure Partners (FEIP) specialist renewables infrastructure fund.

EU Technical Expert Group on Sustainable Finance, March 2020

It is highly likely that the EC will put the Taxonomy into law and make it part of the Non-Financial Reporting Directive. By year-end 2021, investors will thus have to provide reporting on their sustainable investments.

ShareAction, March 2020

ShareAction complements its work on life and pension funds with an overview of the progress of responsible investment also for asset managers. They review governance, climate change, human rights and biodiversity.

World Meteorological Organization, March 2020

This report presents a lot of information on temperature, greenhouse gases and other interesting data. We find it interesting because it is entirely based on empirical facts. It is also a very useful source of data and charts.

McKinsey, January 2020

In this report, McKinsey look at the physical effects of our changing climate. We explore risks today and over the next three decades and examine cases to understand the mechanisms through which physical climate change leads to increased socioeconomic risk

BioScience, January 2020

The report presents a suite of graphical vital signs of climate change over the last 40 years for human activities that can affect GHG emissions and change the climate as well as actual climatic impacts.

Nordsip, January 2020

Foresight Group, an infrastructure and private equity investment manager, announced it secured total commitments to-date of €342 million for the Foresight Energy Infrastructure Partners (FEIP) fund, which targets European sustainable infrastructure projects.

Nordsip, January 2020

NextEnergy Capital (NEC) announced the second close of their flagship NextPower III fund (NPIII), its flagship private ESG infrastructure fund on funding, on Monday, January 13. The fund secured approximately US$118 million in investment commitments.

LUT, December 2019

According to a new study by Finland’s LUT University, solar PV consumes between 2% and 15% of the water that coal and nuclear power plants use to produce just 1 MWh of output; for wind, this percentage ranges from 0.1% to 14%. Under the researchers’ best policy scenario, water consumption could be reduced by 75.1% by 2030, compared to 2015 levels.

IPCC, September 2019

This Summary for Policymakers was formally approved at the Second Joint Session of Working Groups I and II of the IPCC and accepted by the 51th Session of the IPCC, Principality of Monaco, 24th September 2019

Carbon Tracker, September 2019

Falling renewable costs and intermittency solutions drive a tipping point for the Inevitable Policy Response. The Inevitable Policy Response (IPR) is a landmark project to prepare financial markets for a wave of policy moves as governments worldwide are forced to address climate change. A collaboration between PRI, Vivid Economics and Energy Transition Advisors.

Sony Kapoor and Norfund, September 2019

This report shows that the financial system will need to make some deep and fundamental changes, the biggest of which is to focus on intermediating developed economy savings, where investment opportunities are limited, towards promising opportunities in developing economies which are short of investible savings.

World Economic Forum, September 2019

While the global energy system and the factors that impact it are more complex than any scenario or narrative can capture, this paper builds on different existing scenarios and summarizes the main ways in which they differ. It also highlights what to look for over the course of the next decade to see which narrative plays out.

Carbon Tracker, September 2019

In this report, Carbon Tracker lay out their approach and apply it to a universe of the largest listed oil and gas producers. For the first time, they look at alignment in terms of short term actions – which individual projects are non-Paris compliant and shouldn’t go ahead in an economically rational Paris-aligned world, yet nonetheless either a) were sanctioned last year; or b) are targeting sanction this year.

IPCC, August 2019

The latest IPCC report clearly tells us that further pressure on land and ecosystems is a very bad idea. This means, in other words, there will be no land area available for substantial additional biofuels, not for bioenergy CCS and mankind has seriously to re-think the setup of the agricultural industry, with many implications for energy. Highly efficient land-use is mandatory to maintain the natural recovery ability of our planet.

Nature, August 2019

This reports suggest the dawn of a new business model (and a new co-mingled asset class) – the agrivolataic system – as a research team at Oregon State University has found the greatest solar PV efficiency in panels co-located with crops. It more than blows away the incumbency argument, that we get all the time, that “solar needs too much valuable farm land.” Indeed, as the authors calculate, “global energy demand would be offset by solar production if even <1% of cropland were converted to an agrivoltaic system.” Puts the recent IPCC report (August 2019) into context!

Jeremy Leggett, August 2019

In this potentially game-changing report, BNP Paribas introduces the concept of Energy Return on Capital Invested. The report concludes that “The economics of oil for gasoline and diesel vehicles versus wind- and solar-powered EVs are now in relentless and irreversible decline, with far-reaching implications for both policymakers and the oil majors.”

Solar Trade Association, 2019

Britain’s large-scale solar PV industry delivering benefits for biodiversity and sustainable agriculture.

Dan Wells at Foresight Group, July 2019

The problem with climate change is not other people, it is ourselves (and physics).

Jeremy Legget, June 2019

A review of the four sub-targets of SDG7, the extent to which the international community is behind the pace on each, and how this can be fixed, with emphasis on investment.

Dan Wells at Foresight Group, May 2019

A career in finance is rarely what we dream of when we are children. But forget being a rock star, a football pro or a contestant on Love Island. Here’s why working in sustainable investing is the best job. Ever.

Deloitte, May 2019

Deloitte just released The Global Millenial Survey 2019. Among 20 challenges facing society that most concern respondents on a personal level, climate change/protecting the environment/natural disasters topped the list.

Aline Reichenberg Gustafsson at Nordsip, May 2019

Just a week after the AP3 broke the news that Pablo Bernengo would take over the reins from acting CIO Kerim Kaskal, Worthwhile Capital Partners announces that Kaskal is joining the firm as a Partner. Worthwhile was founded in late 2018 by CEO Christian Andersson, to help managers raise money in sustainable investment strategies.

Bloomberg, April 2019

Co-locating wind and solar can bring a number of benefits over single-technology projects. And it is not only about sharing costs. As wind and solar generation profiles are complementary, adding solar to an existing grid connection results in little curtailment, firmer output and less stress on weak grids – and allows asset owners to negotiate better PPAs.

NextEnergy Capital, April 2019

NextPower III, NEC’s third solar fund investing globally is pleased to announce its first acquisition of two development projects in Virginia, USA totalling approximately 46MWp/34MWac. These two projects represent NextEnergy Capital‘s first utility-scale solar venture in the United States for their new fund, NextPower III. The two solar projects will cover approximately 300 acres and generate electricity equivalent to the consumption of 9,785 homes.

Jeremy Leggett, April 2019

This Power Point presentation is a short introduction to a historic report, published 12th April 2019 by LUT University and Energy Watch, that models the global energy system on an hourly basis using the real economics of existing renewable energy technologies. A unique first, and essential ammunition for all worried about climate change.

LUT and Energy Watch Group, April 2019

The sustainable energy system is more efficient and cost effective than the existing system, which is based primarily on fossil fuels and nuclear. A global renewable transition is the only sustainable option for the energy sector, and is compatible with the internationally adopted Paris Agreement. The energy transition is not a question of technical feasibility or economic viability, but one of political will.

Sony Kapoor at RE-DEFINE, March 2019

The report outlines why the mobilisation potential of blending has been oversold through the Billions to Trillions agenda, by a factor of ten, and how continued blending evangelism will be unhelpful in reaching the Sustainable Development Goals.

Aline Reichenberg Gustafsson at Nordsip, January 2019

Renewable energy-focused private equity manager NextEnergy Capital recently announced the first close of its new fund NextPower III International Solar Fund, the firm’s first private equity fund to focus exclusively on the international solar energy infrastructure sector.

Sony Kapoor at RE-DEFINE, April 2018

This report discusses funding the Sustainable Development Goals, with a particular focus on tackling excessive levels of indebtedness, fighting tax evasion and capital flight from developing economies, as well as mobilizing private capital. It shows why $80 trillion of long-term institutional capital should invest in emerging and developing economies to generate additional returns and diversify risk.

Sony Kapoor at RE-DEFINE, January 2019

This new Re-Define report, written for ZERO, examines three big issues that are part of the ongoing policy discussions in Norway. The analysis is equally applicable to all other fossil fuel-funded sovereign wealth funds.

NextEnergy Capital, November 2018

NextEnergy Capital Group (“NEC”), the leading international solar investment and asset manager with solar AUM of US$1.4bn, announces the first close of NextPower III, its flagship private equity fund focused on funding the construction and long-term ownership of new-build solar power plants across international markets. NextPower III has secured initial commitments of c.US$160m, and has a fundraising target of US$750m.

Asset Owners Disclosures Project, November 2018

The report uses new data to rank the world’s 100 largest public pension funds on their approach to climate-related risks and opportunities. These pension funds were selected based on the size of assets under management. Over 60% of pension funds publish little or no information on their climate responses, placing them at risk of breaching their legal duties to their beneficiaries.

Asset Owners Disclosures Project, November 2018

This report contains practical solutions and building blocks for asset owners from beginner to best practice. It is based on interviews with 22 leading asset owners, this report explores the current best practices landscape, identifies barriers, and presents a framework of ten building blocks for other asset owners introducing and developing climate strategies.

Asset Owners Disclosures Project, May 2018

This report assesses the insurance sector response to the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and features an index of the world’s 80 largest insurers rated on their approach to climate-related risks and opportunities.

Eurosif, November 2018

This 2018 SRI Study gives a fair representation of the European SRI industry for the past two years, across a range of investment approaches as defined by Eurosif. The data collected for this Study, at the end of 2017, al- lowed us to cover institutional and retail assets from 12 different European markets.

Sony Kapoor at RE-DEFINE, August 2017

The Report looks at why sustainable investing makes financial sense for institutional investors such as the Norwegian Sovereign Wealth Fund. It demonstrates the key trends in the industry, and shows how investing sustainably is key for long-term returns. Main ESG principles are discussed, exploring how various institutional investors are incorporating sustainability in their investment strategies.